When travelling with large amounts of money, it is important to understand the legal requirements for declaring it at your destination. The laws vary depending on the country and the amount of money, but generally, travellers must declare amounts exceeding a certain threshold. For example, in the US, travellers must report over $10,000 to a Customs and Border Protection (CBP) officer, while in the EU and Spain, the threshold is €10,000. Failure to declare can result in confiscation of funds, fines, or even imprisonment.

| Characteristics | Values |

|---|---|

| Amount of money that must be declared | More than $10,000 in the US; €10,000 or more in the EU and Spain |

| What counts as a method of payment? | Cash, paper money, coins, bank cheques, traveller's cheques, negotiable instruments, promissory notes, money orders |

| Where to declare | To a Customs and Border Protection (CBP) officer in the US; customs in the EU and Spain |

| When to declare | Before entering or leaving the country |

| How to declare | Using the appropriate form: Currency Reporting Form (FinCen 105) in the US; EU Cash Declaration Form in the EU; Form S-1 in Spain |

| What happens if you don't declare | Penalties may include confiscation of all currency, a fine of up to $500,000 in the US, or a fine of up to twice the total amount of money intercepted in Spain |

What You'll Learn

Monetary instruments that need to be declared

> "United States coins and currency; coins and currency of a foreign country; travellers' checks; bearer negotiable instruments; bearer investment securities; bearer securities; stock on which title is passed on delivery; and similar material."

This definition also includes "checks, drafts, notes, money orders, and other similar instruments drawn on or by a foreign financial institution and are not in bearer form." Essentially, any form of payment that can be easily transferred anonymously across borders needs to be declared.

In the EU, the threshold for declaring monetary instruments is EUR 10,000 or more in cash. This includes both entering and exiting the EU, and the specific declaration form varies depending on the country.

Monetary instruments can also include tangible prepaid access devices, such as prepaid cards, gift cards, store cards, payroll cards, and government benefit cards. These devices are considered monetary instruments when they can be used to obtain access to prepaid funds or the value of funds by the possessor, regardless of whom the prepaid access is issued to.

It is important to note that credit cards and debit cards are generally not considered monetary instruments. However, the specific regulations may vary depending on the country or region, so it is always advisable to check the relevant government guidelines before travelling.

Barcelona Airport: Free Wifi Access for Travelers

You may want to see also

How to declare money at customs

When travelling, you may need to declare how much money you have on you at customs. This is a security measure to prevent money laundering and the financing of terrorism.

EU

If you are entering or leaving the EU with €10,000 or more in cash, you must declare it to Customs. This includes the equivalent sum in other currencies, and other means of payment such as cheques, gold coins, and gold bars. You can declare this by filling out a cash declaration form and submitting it to Customs upon arrival or departure. You can fill out the form in advance and print it, or ask for a paper copy at the border crossing point. You will also need to enclose a copy of your passport or ID card.

United States

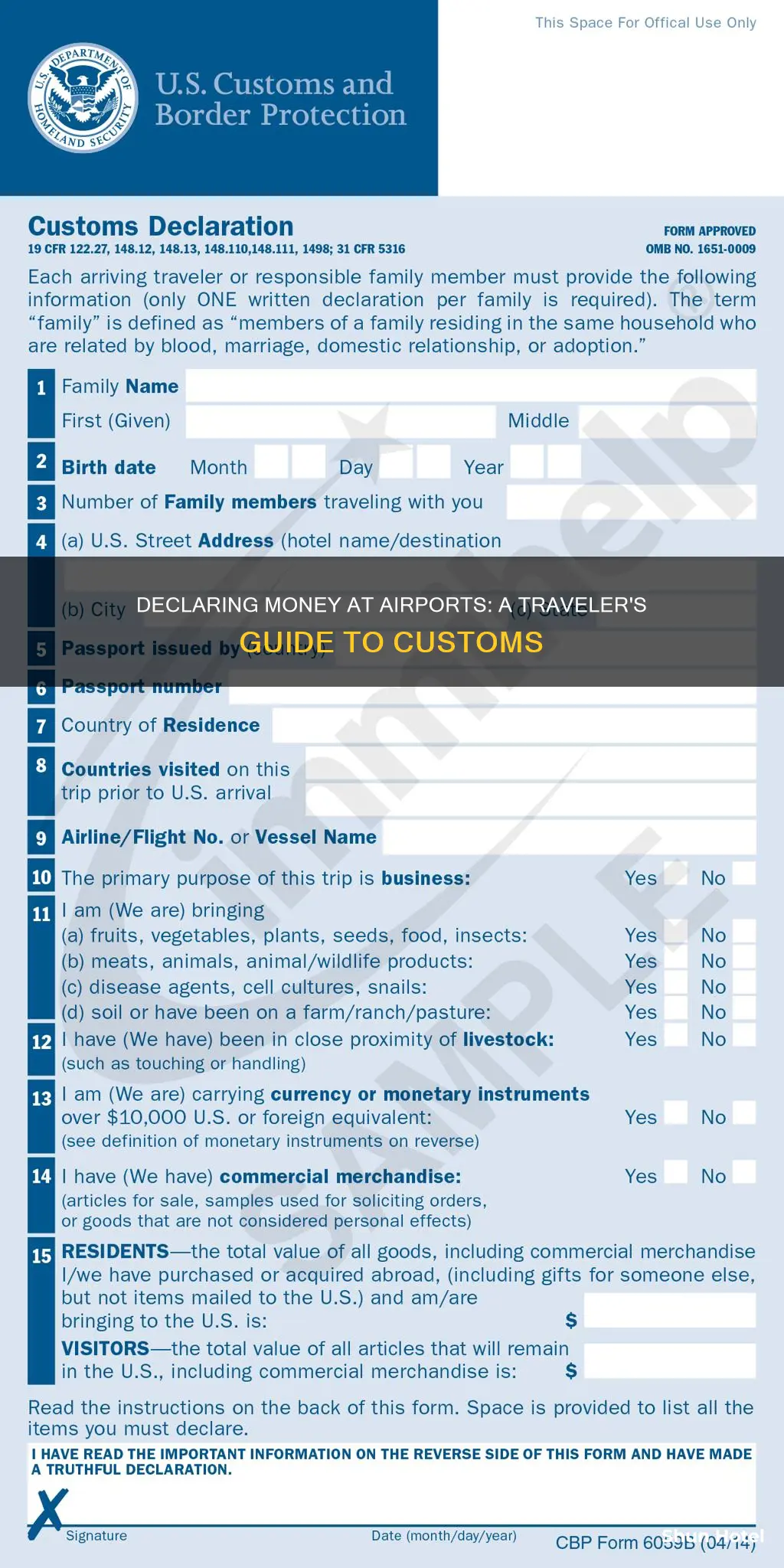

If you are travelling with more than $10,000, you must report it to a Customs and Border Protection (CBP) officer when entering or exiting the US. You can do this by filling out the Currency Reporting Form (FinCen 105) online, or by filling it out before you travel and presenting it to a CBP officer. You can also ask a CBP officer for a paper copy at customs. If you are an international traveller entering the US, you must also declare the amount of money you have on a CBP Form 6059B.

Frankfurt Airport: On-Site Hotels for Convenient Layovers and Stays

You may want to see also

The consequences of not declaring money

When travelling, it is important to declare any money exceeding the amount of $10,000 or €10,000 to a Customs and Border Protection (CBP) officer. Failing to do so can result in serious consequences. Here are some of the potential outcomes:

Confiscation of Currency or Monetary Instruments

If individuals do not declare the required amount of money at the airport, authorities may confiscate all the currency or monetary instruments in their possession. This means that travellers could lose all the money they intended to bring across borders.

Monetary Fine

In addition to confiscating the currency, travellers may also face significant monetary fines. In the United States, for example, the fine for failing to declare more than $10,000 can be up to $500,000. This serves as a substantial penalty for not complying with the declaration requirements.

Imprisonment

Not declaring money at the airport can also lead to legal consequences, including imprisonment. In the US, for instance, travellers who do not properly report their currency may face up to 10 years in jail. This is a severe punishment that underscores the importance of adhering to declaration rules.

Disruption to Travel Plans

When travellers do not declare the required amount of money, they may experience significant disruptions to their travel plans. They may be detained for questioning, miss connecting flights, or face increased scrutiny and delays during their journey. This can cause inconvenience and stress, affecting their overall travel experience.

Impact on Future Travel

It is important to be aware of the specific rules and regulations of the countries travellers are visiting or transiting through. By understanding the requirements and taking the necessary steps to declare their currency, travellers can help ensure a smooth journey and avoid the potential consequences of non-compliance.

Birmingham Airport: Navigating Stairs and Steps

You may want to see also

The limit on how much undeclared money you can carry

When it comes to travelling with cash, there is a limit on how much undeclared money you can carry. This limit varies depending on the country or region you are entering or exiting. Here is an overview of the requirements for different locations:

United States

In the United States, there is no limit to the amount of cash or monetary instruments you can bring into the country. However, if you are travelling with more than $10,000 USD, you must declare this amount to U.S. Customs. This includes both physical currency and other monetary instruments such as traveller's checks, money orders, and negotiable instruments. To declare, you can fill out the FinCEN Form 105 online, print it and present it to a Customs and Border Protection (CBP) officer, or ask a CBP officer for a paper copy at customs. This declaration is required for both U.S. citizens and foreign visitors, and failure to do so can result in cash seizure, fines, or even legal penalties.

European Union

When entering or exiting the European Union, a similar rule applies. If you are carrying EUR 10,000 or more in cash, you must declare it to Customs using the EU Cash Declaration Form. This form is available in all EU languages and must be completed using the official national language(s) of the country you are entering or leaving.

Domestic Flights

For domestic flights within the United States, there is no legal limit on the amount of cash you can carry. The Transportation Security Administration (TSA) does not restrict the amount of cash travellers can bring on board. However, large amounts of cash may attract additional scrutiny from law enforcement officials, who may inquire about the source and intended use of the funds.

Arriving Early: Navigating Airport Timing Stress-Free

You may want to see also

The reason for declaring money at the airport

When travelling with large amounts of money, it is important to declare this at the airport to comply with customs regulations. Many countries have thresholds for the amount of money that can be carried across their borders without being declared. For example, in the US, travellers must report amounts exceeding $10,000 to a Customs and Border Protection (CBP) officer when entering or exiting the country. Similarly, in the EU, travellers must declare amounts of 10,000 euros or more to Customs.

By declaring money at the airport, travellers can ensure they are complying with the laws and regulations of the country they are entering or exiting. This helps to prevent money laundering and other financial crimes. It also allows governments to monitor and control the flow of currency in and out of their country.

Failing to declare money at the airport can result in serious consequences. In the US, for instance, not reporting amounts over $10,000 to CBP can lead to confiscation of the currency, civil penalties such as fines, and even criminal penalties, including prison time. Therefore, it is crucial for travellers to be aware of the declaration requirements and to truthfully complete the necessary forms, such as the FinCEN Form 105 and CBP Form 6059B in the US, prior to or upon arrival at customs.

Additionally, declaring money at the airport can provide travellers with peace of mind and help protect their assets. Carrying large amounts of cash can make travellers a target for robbery or theft. By declaring the money to customs, travellers can demonstrate that they are complying with the law and reduce the risk of having their assets confiscated or facing other penalties.

Maui Airport Shuttle Services: What You Need to Know

You may want to see also

Frequently asked questions

In most places, you can carry up to €10,000 or $10,000 without declaring it. In Spain, this limit is lower at €1,000.

If you fail to declare money over the limit, it will likely be confiscated by customs or police officers. You may also face a fine or even imprisonment.

Cash, bank cheques, and any other physical or electronic form of money, including travellers' cheques and money orders, need to be declared.