Hartsfield Jackson Atlanta International Airport (ATL) has currency exchange services available, but be aware that airport currency exchange services are often costly due to high fees and unfavourable exchange rates. While convenient, exchanging currency at the airport is generally not the best option for getting the most out of your money.

| Characteristics | Values |

|---|---|

| Currency exchange available | Yes |

| High fees | Yes |

| Better rates available elsewhere | Yes |

| Business hours | Saturday-Friday: 6:00 AM - 10:00 PM |

| Contact number | 404-205-5800 |

| Address | 2600 Maynard H Jackson Jr Blvd Atlanta, Georgia 30320, United States of America |

What You'll Learn

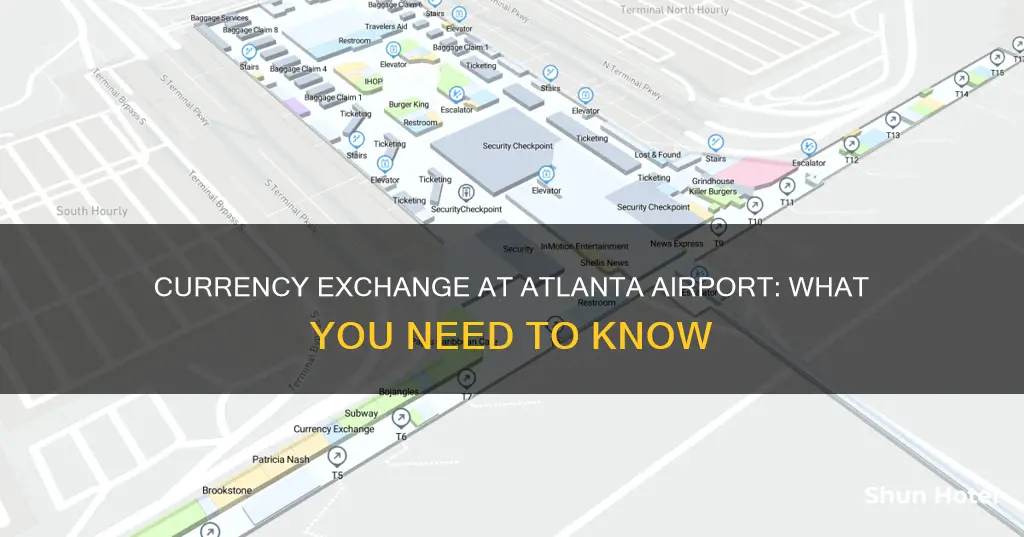

Currency exchange at Atlanta Airport is costly

Currency exchange services at Hartsfield Jackson Atlanta International Airport (ATL) can be costly. The airport has one currency exchange location, with 12 outlets operated by Travelex. While convenient, airport currency exchange services are known for offering poor exchange rates and high fees due to a lack of competition.

Travelex offers two options at Atlanta Airport: ordering currency online in advance for collection at the airport or buying currency directly from one of their stores. However, you may find better exchange rates by ordering currency online before travelling to the airport or using a different currency exchange provider altogether. For example, you could order currency online from a provider like Wise, which offers conversions at the mid-market exchange rate without markups or hidden fees.

Additionally, using a multi-currency card or travel card can be a more cost-effective alternative to exchanging physical currency at an airport. These cards allow you to spend in multiple currencies and often provide better exchange rates than traditional currency exchange services. It is also worth considering using an ATM to withdraw cash in the local currency when you arrive at your destination, as this can offer a better exchange rate than airport currency exchange services. However, be sure to check for any high fixed fees or foreign transaction fees associated with ATM withdrawals or card usage overseas.

Overall, it is important to compare exchange rates and fees when using currency exchange services at Hartsfield Jackson Atlanta International Airport (ATL) to avoid paying high costs. By planning ahead and exploring alternative options, you can often find more favourable rates and save money on your currency exchange.

Exploring Atlantis: Airport Shuttle Services and Accessibility

You may want to see also

Travelex has 12 outlets at the airport

Hartsfield-Jackson Atlanta International Airport has 12 Travelex outlets where you can exchange currency. While it is convenient to exchange currency at the airport, it is important to note that airport exchange rates are notoriously bad. This is because people passing through an airport are a captive market, and they don't usually have many other places to go to get foreign currency before reaching their destination.

If you want Travelex's best exchange rate, it is recommended that you book your currency online before collecting it at the airport. However, if you want an even better exchange rate, you may need to look elsewhere or compare Travelex's rates to the real mid-market rate using an online currency converter.

In addition to Travelex, there are several other currency exchange options at the airport, including ICE and ATMs. However, keep in mind that exchange rates at the airport are likely to be higher than those in the city.

To get the best exchange rate, it is generally recommended to order foreign cash from your bank before your trip or to use an ATM in your destination country to withdraw local currency. By using your bank's exchange rate or choosing to pay in the foreign currency, you can avoid the high fees and poor exchange rates often associated with airport currency exchanges.

Shuttle Services: Charlotte Airport Transportation Options

You may want to see also

Avoid airport currency exchange with a multi-currency card

When travelling to a foreign country, it is essential to have local currency. While it may be tempting to exchange currency at the airport, this is often not the best option due to unfavourable exchange rates and high fees. Here are some reasons why you should avoid airport currency exchange and opt for a multi-currency card instead:

Poor Exchange Rates

Currency exchange kiosks at airports often offer poor exchange rates that are significantly worse than the mid-market rate. The mid-market rate is the average of the current buy and sell rates between two currencies. By marking up this rate, currency exchangers at airports can make a profit, even if they advertise "no fees". As a result, you may end up with less foreign currency than you expected.

High Fees

In addition to poor exchange rates, airport currency exchange services often charge various fees. These fees may be concealed within the exchange rate, making it difficult to compare rates and understand the true cost of the transaction.

Alternative Options

Instead of exchanging currency at the airport, consider using a multi-currency card. These cards allow you to spend, receive, and hold multiple currencies in one account. Fintech companies like Wise and Revolut offer multi-currency accounts online and through mobile apps. By using a multi-currency card, you can avoid the hassle and cost of exchanging cash and benefit from competitive exchange rates and low fees.

Plan Ahead

It is important to plan ahead when it comes to exchanging currency. Consider exchanging your money before your trip or using a foreign ATM when you reach your destination. Your bank's ATM network is likely to offer competitive exchange rates and low fees, and you can use your institution's app to find an ATM near you.

In summary, avoid exchanging currency at airport kiosks and opt for a multi-currency card instead. By planning ahead and utilising alternative options, you can get better exchange rates, avoid high fees, and make the most of your money during your travels.

Detroit Airport: Customs Clearance and Passenger Experience

You may want to see also

Compare exchange rates to the real mid-market rate

When exchanging currency, it's important to compare the exchange rates offered by different providers to the mid-market rate, which is considered the "real" and fairest rate. The mid-market rate is the midpoint between the buy and sell prices that banks and providers are willing to pay and receive for a currency. This rate is influenced by external economic factors and fluctuates constantly as currencies are traded globally.

To calculate the mid-market rate, you can use trusted sites like Bloomberg or Yahoo Finance, which provide real-time updates on exchange rates. Additionally, some online tools and calculators can help you compare exchange rates and determine the most favourable option. It is recommended to shop around and stay informed about the mid-market rate to make informed financial decisions.

For example, let's consider the exchange rates offered at Atlanta International Airport (ATL). According to their website, on March 17, 2025, the exchange rate for 1 USD to EUR was offered as 1 USD = 0.813045 EUR or 1 USD = 1.169992 EUR. By comparing these rates to the mid-market rate for that day, you can assess the fairness of the offered rates.

When exchanging currency, it is generally advised to avoid exchanging money at airports due to unfavourable rates. Instead, consider using ATMs in your destination country to withdraw local currency or order foreign cash from your bank before departing to obtain better exchange rates. Additionally, ensure that your credit and debit cards have no foreign transaction fees to avoid unnecessary charges.

Airports Facing Temporary Shutdowns: Current Status and Insights

You may want to see also

Get cash from an ATM at your destination

If you're travelling abroad, it's always a good idea to have some local currency in your wallet when you arrive. While you can exchange currency at Atlanta Airport, the exchange rates and fees on offer at the airport aren't always the best available.

A good alternative is to get cash from an ATM at your destination. This way, you can avoid carrying large amounts of cash, and you may find that the fees are lower than using a currency exchange service.

- Check your cards for foreign transaction fees: Before you go, make sure there are no foreign transaction fees on your credit or debit cards. If your card does have foreign transaction fees, it might be best to withdraw cash from an ATM at an amount you're comfortable with carrying.

- Notify your bank of your travel plans: It's always a good idea to let your bank know about your travel plans, so they don't flag your card activity as suspicious and block your card.

- Be mindful of ATM operators' fees: While Travelex ATMs, for example, don't charge ATM fees, some operators may charge their own fee or set their own limits. It's always good to check with the ATM operator or your bank before using an ATM abroad.

- Choose local currency: When given the option, always choose to withdraw cash in the local currency. This way, you let your bank handle the conversion and avoid the often unfavourable conversion rates offered by the ATM.

- Use a card with no exchange fee: If you have a card with no exchange fee or transaction charges, it's best to use that for your cash withdrawals. That way, you can be sure to get the daily exchange rate without any additional charges.

By following these tips, you can get cash from an ATM at your destination safely and cost-effectively.

London's LHR Airport: A Traveler's Guide

You may want to see also

Frequently asked questions

Yes, currency exchange services are available at Atlanta International Airport (ATL).

The business hours vary depending on the specific location within the airport. Some locations operate from 6:00 AM to 10:00 PM daily, while others have reduced hours on Saturdays and Sundays, opening from 12:00 PM to 8:00 PM.

Exchange rates at airports are generally not favourable and tend to be higher than those offered elsewhere. It is recommended to compare the rates with the mid-market rate or order currency in advance online to secure a better rate. Additionally, using an ATM or a credit card that does not charge foreign transaction fees can be a more cost-effective alternative.