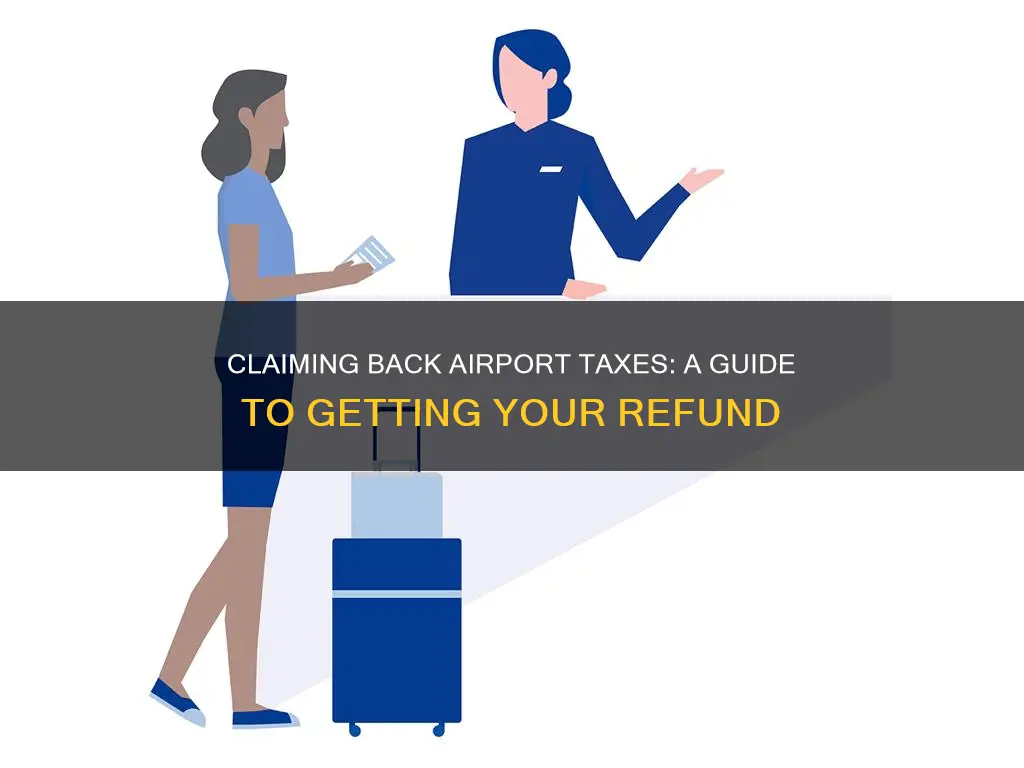

If you've missed a flight, or you've had to cancel your ticket, you may be entitled to a refund of the airport taxes and fees. This is because you haven't used the flight and are therefore not liable to pay these costs. Airlines will often refund the airport taxes and fees for unutilised tickets, no shows, and missed flights.

| Characteristics | Values |

|---|---|

| When to apply for a refund | If you are unable to travel, miss your flight or are a no-show |

| How to apply for a refund | Contact the airline and provide your booking reference or ticket number, contact details and a copy of your exemption certificate (if applicable) |

| What you are refunded | Applicable airport taxes, statutory taxes, User Development Fee (UDF), Airport Development Fee (ADF) and Passenger Service Fee (PSF) |

What You'll Learn

How to get a refund on unutilised tickets

If you have unutilised tickets, you are entitled to a refund of the applicable airport taxes. This is because you have not used the flight and are therefore not liable to pay these costs.

To claim a refund, you will need to contact the airline. You may be able to do this online by clicking 'Edit Booking' and entering your booking reference number and email address. Alternatively, you can send an email to the airline with your booking reference or ticket number, contact details and a copy of your exemption certificates (if applicable).

Airports Galore: Which Country Has the Most?

You may want to see also

How to get a refund on a no-show

If you are unable to travel, you can obtain a refund for unutilised tickets and no-shows. This includes a refund of all statutory taxes and fees. To claim a refund for a no-show, you can usually edit your booking online and enter your booking reference number and email address. Alternatively, you can contact the airline by email, providing your booking reference or ticket number, contact details, and a copy of your exemption certificate (if applicable).

It is important to note that you are entitled to a refund of at least part of the ticket fare when you cancel a flight, regardless of the reason. This includes a refund of the base fare, taxes, and fees. Therefore, even if you do not notify the airline that you will miss your flight, you can still receive a refund for the costs of the taxes and fees.

However, if you miss your outward flight and still wish to take your return flight, it is advisable to check with the airline whether you are permitted to travel on the return flight to avoid any issues.

Johannesburg Airport ATMs: Do They Accept Plus Cards?

You may want to see also

How to get a refund on a missed flight

If you miss your flight, you are entitled to a refund of the taxes and fees from the airline. This is because you have not used the flight and are therefore not liable to pay these costs. To claim a refund, you will need to provide your booking reference or ticket number, as well as your contact details. You may also need to provide a copy of your booking confirmation or other relevant documents.

It is important to note that if you miss your outward flight and still wish to take your return flight, the airline may forfeit your entire ticket. Therefore, it is advisable to check with the airline whether you are permitted to travel on your return flight to avoid any issues.

Each airline will have a different process for claiming a refund, so be sure to check their website or contact their customer service team for specific instructions. Some airlines may allow you to claim a refund online by editing your booking and entering your booking reference and email address. Others may require you to send an email or fill out a form to request a refund.

In some cases, you may be entitled to a refund of the base fare in addition to the taxes and fees. This will depend on the airline's policies and the specific circumstances of your missed flight. It is always a good idea to know your rights as an air passenger and understand what you should receive from the airline in the event of a cancellation or missed flight.

Amtrak's Seattle Airport Stop: What Travelers Need to Know

You may want to see also

How to get a refund on a cancelled flight

If you need to cancel your flight, you are entitled to a refund of at least part of the ticket fare. This includes the base fare, taxes and fees. You can claim a refund on the taxes and fees even if you cancel right before the flight departs or do not notify the airline at all.

To claim a refund, you will need to contact the airline. Some airlines allow you to do this by clicking 'Edit Booking' and entering your booking reference number and email address. Others may require you to send an email with your booking reference or ticket number, contact details and a copy of your exemption certificate.

Paris Passes: Airport Transfers and What to Know

You may want to see also

How to get a refund on airport taxes when departing from Manila

If you are departing from Manila's Ninoy Aquino International Airport (NAIA), you will probably be charged a terminal fee, also known as the Passenger Service Charge, which costs PhP550 per passenger. However, if you do not end up travelling on the flight, you are eligible for a refund of the terminal fee. Depending on the route and airline, you may also be eligible for a refund on other fees charged to you.

If you have paid travel tax twice for the same ticket, you can get a travel tax refund. To do this, you will need to gather all your documents and go to the Travel Tax Center. If you are not the payee, you will need a Special Power of Attorney. If you are a parent of a minor payee, bring your child's birth certificate. Then, fill out a TIEZA refund application form and present the documents to the TIEZA Centers. You can usually get your refund within three working days, but you can also avail the one same-day refund. You can also get your refund within two years from the date of departure or payment. You may need your passport and proof of payment. In some cases, the travel tax might be included in your airline ticket price, in which case your airline ticket serves as proof of payment.

If you are an Overseas Filipino Worker (OFW), you will no longer be required to pay the Passenger Service Charge (LI) tax when departing from Manila. If you were charged the LI tax, you are entitled to a full refund provided you qualify as an OFW. To get a refund, go to the Manila government office located at the airport, with the following exemption certificates: an overseas employment certificate (OEC) issued by the Philippine Overseas Employment Administration (POEA) clarifying that the bearer is an OFW.

If you cancel your flight ticket, you are entitled to at least part of the ticket fare, regardless of your reason for doing so. You can be refunded the costs of the taxes and fees, even if you cancel right before the flight departs or do not notify the airline at all that you will miss the flight. In the case of a missed flight or no show, all statutory taxes and User Development Fee (UDF)/Airport Development Fee (ADF)/Passenger Service Fee (PSF) will be refunded.

Kolkata Airport: Runways and Their Operations Explained

You may want to see also

Frequently asked questions

Yes, you will be refunded the airport taxes.

You will be refunded the airport taxes.

You can apply for a refund by contacting the airline.

Yes, you will need to provide your booking reference or ticket number, contact details, and a copy of a relevant document.

It is advisable to check with the airline whether you are permitted to travel on your return flight, as the airline may forfeit the entire ticket.