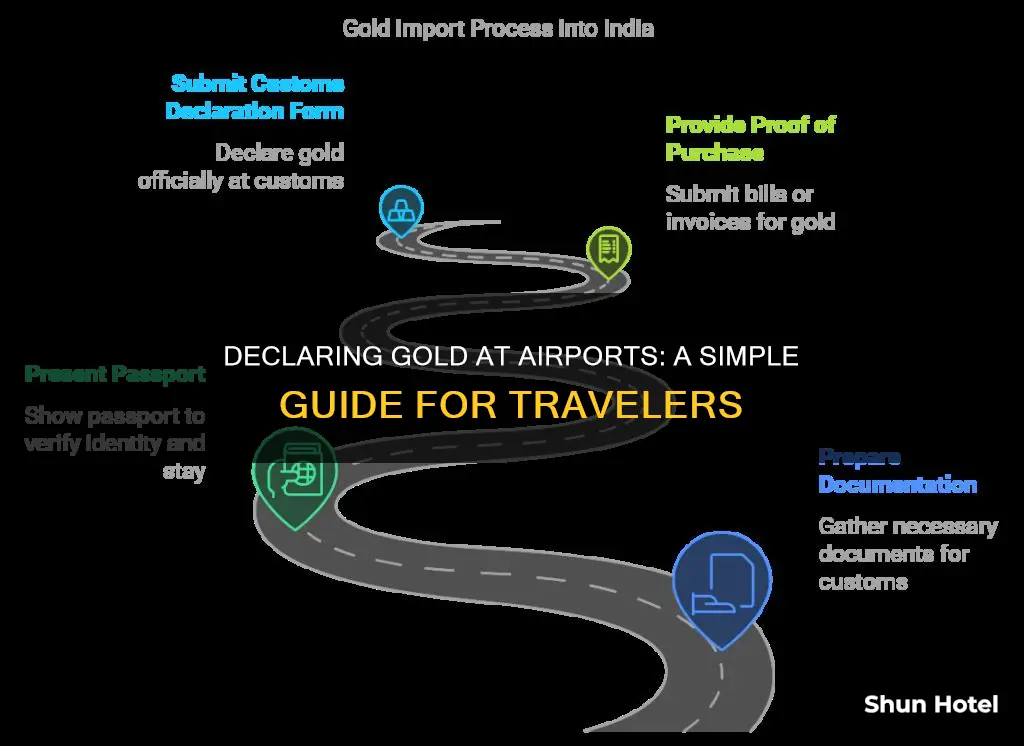

Travelling with gold can be a complicated process, with various rules and regulations to follow. Most governments have specific rules for individuals travelling with gold, and it's important to understand these to avoid any issues when passing through airport security. In this paragraph, we will explore the key considerations for declaring gold at the airport, including weight restrictions, declaration forms, and import taxes. By understanding the relevant laws and requirements, travellers can ensure a smooth journey when transporting gold.

| Characteristics | Values |

|---|---|

| Amount of gold | No limit to the amount of gold you can travel with domestically or internationally |

| Reporting Requirements | Gold coins or bullion of any amount must be reported to Customs and Border Protection (CBP) when travelling to the US |

| Import Taxes | Some countries levy import or duty taxes on gold assets |

| Proof of Ownership | Carry proof of ownership such as receipts, certificates, invoices, or other forms of recognised and official documentation |

| Weight Restrictions | Contact the airline to check weight restrictions for hand luggage |

What You'll Learn

Declare gold at Customs and Border Protection (CBP)

When entering the USA, all gold items must be declared to U.S. Customs and Border Protection (CBP). This is a crucial step to ensure you don't face any legal complications. The declaration can be done using the CBP Form 6059B. It is important to be as transparent as possible and provide detailed information about the gold you are carrying.

If you are travelling with more than $10,000 worth of gold, you will need to fill out a FinCEN 105 declaration form in addition to the CBP form. This is a crucial step to avoid any delays or misunderstandings with customs officers. It is also important to carry proof of purchase, such as invoices or receipts, to establish ownership and value. These documents will help in determining the applicable duties and taxes.

Gold bullion, in particular, is subject to duty and IRS reporting requirements. The duty rate on gold jewellery is typically around 5.5%, but this can vary. The duty and taxes are calculated based on the value of the gold items, so it is essential to declare the correct purchased value or fair market value. Payments for these can be made at the port of entry using cash, cheque, or major credit cards.

It is also important to note that certain coins are prohibited from being imported into the United States. Currently, gold produced in Iran, Sudan, or Cuba cannot be brought into the country. Only LBMA-approved gold is permitted.

Bowling Green: Airport Accessibility and Travel Options

You may want to see also

Wear gold items if possible

If you are travelling with gold, especially gold jewellery, it is a good idea to wear the gold items if possible. This way, you can avoid having to pack the gold items in your luggage, where they may be at risk of being lost or damaged, or stolen. Wearing gold items also makes it easier to prove that the gold is for personal use, rather than for resale. If you are travelling with a lot of gold, it may be impractical to wear it all. In this case, you could consider packing some of the gold items in a carry-on bag, so that they remain within your sight at all times.

When deciding whether to wear your gold items, it is important to consider the security measures at the airport. You may be required to remove jewellery when passing through metal detectors or other security screening devices. Additionally, if you are wearing a large amount of gold jewellery, you may attract attention from security personnel or other travellers, which could increase the risk of theft.

It is also worth noting that some countries have specific regulations regarding the importation of gold. For example, in the United States, gold coins, bullion, and medals are generally permitted entry, as long as they are not coming from embargoed countries such as Sudan, Iran, or Cuba. However, any gold items worth more than $10,000 must be reported to Customs and Border Protection (CBP) and may be subject to duties or taxes. Therefore, if you are wearing gold items that exceed this value, you should be prepared to declare them upon entry to the country.

Overall, wearing gold items when travelling can be a convenient way to keep your gold secure and avoid potential delays or issues at the airport. However, it is important to be aware of the relevant regulations and security measures that may apply to your specific situation.

Uber's Airport Reliability: Is It Worth the Risk?

You may want to see also

Provide proof of ownership

When travelling with gold, it is recommended to carry proof of ownership. This can include receipts, certificates, invoices, or other forms of recognised and official documentation. These documents can help establish the authenticity of the gold and prove your rightful ownership. They can also dispel any suspicion that the gold is of questionable origin.

For instance, if you are travelling to the US with gold, you must declare it to Customs and Border Protection (CBP) Officers. If the gold is worth more than $10,000, you will need to fill in a FinCEN 105 declaration form. In this case, it is recommended to have proof of purchase, such as an invoice or receipt of payment, to avoid any unnecessary delays. This will help prove that you are the legal owner of the gold and avoid any suspicion that you are attempting to avoid paying customs fees.

Similarly, if you are travelling to the UK with gold, you will need to declare it if you intend to sell it in the country. Customs agents will then determine whether you need to pay duty charges. Having proof of ownership in this case can help establish that you are the rightful owner of the gold and that you are not attempting to avoid paying any necessary charges.

When travelling to India with gold, there is a 1kg weight limit. If you are carrying more than this, you will have to pay additional duty charges and a 12.5% import tax. Having proof of ownership in this case can help you establish the value of the gold and ensure that you are paying the correct amount of taxes and charges.

Overall, carrying proof of ownership when travelling with gold can help streamline the process and avoid any potential issues or delays. It can also provide peace of mind and ensure that you are complying with the relevant regulations and laws.

Airport Security: Efficiently Navigate and Understand Screening Processes

You may want to see also

Contact customs 24 hours before travelling

Contacting customs at least 24 hours before travelling is a highly recommended step when transporting gold across international borders. This proactive approach can save you a lot of time and potential delays at security checkpoints.

When you contact customs, inform them that you will be travelling with gold coins, bullion, jewellery, or other gold items. Ask if there are any specific procedures for transporting gold that you need to follow. This advance notice can streamline your airport experience and ensure you are fully compliant with the law.

Different countries have varying regulations regarding gold transportation. For example, when entering the United States, gold coins, bullion, and medals are allowed as long as they are not from embargoed countries such as Sudan, Iran, or Cuba. A FinCEN 105 form must be completed if the value of the gold exceeds $10,000, and items below this amount must still be declared. On the other hand, the UK requires declaration for restricted or banned items, items in excess of duty-free allowance, and items intended for resale.

It is important to be transparent and forthcoming with information to avoid any misunderstandings or delays. Customs officers may suspect that you are attempting to conceal the gold, avoid customs fees, or that you are not the legal owner of the items if you do not declare them. Therefore, it is beneficial to be proactive and contact customs in advance to understand their specific requirements and procedures.

What's Behind the Name "Airport Fire"?

You may want to see also

Request a private screening

Requesting a private screening is a good idea when travelling with gold, especially if you are carrying a significant amount.

If you are travelling with gold, you should expect that it will be picked up by X-ray machines at the airport. This will likely prompt a search of your luggage. You can request a private screening to ensure that your gold assets remain secure and to protect your privacy.

The Transportation Security Administration (TSA) in the US outlines that private screenings are available upon request and you can even have a witness of your choice present.

It is a good idea to communicate with the relevant authorities before your flight to avoid misunderstandings and delays. This includes informing airport security and customs agents of your gold before you arrive at the airport.

When travelling with gold, it is recommended to keep it in your hand luggage or carry-on bag, so it remains within sight at all times.

Claiming Crypto at Airports: A Guide to Navigating Customs

You may want to see also

Frequently asked questions

Yes, gold must be declared at the airport.

If you fail to declare your gold, customs officers may suspect that you are attempting to conceal the gold, avoid paying customs fees, or that you are not the legal owner of the gold. This could lead to delays in security or confiscation of your gold.

The process of declaring gold at the airport may vary depending on the country and the value of the gold. In general, it is recommended to communicate with the relevant authorities, such as airport security and customs agents, in advance to ensure a smooth process. It is also important to have proper documentation, such as proof of ownership and value, to establish the authenticity and lawful possession of the gold.