When travelling with large amounts of money, it is important to understand the rules around declaring currency. Many countries have limits on the amount of money that can be brought in or taken out without being declared. For example, in the US, travellers must report to a Customs and Border Protection (CBP) officer if they are entering or exiting the country with more than $10,000. This can be done by filling out the Currency Reporting Form (FinCen 105) online, printing it out before travelling and presenting it to a CBP officer, or asking for a paper copy at customs. Failure to declare can result in serious penalties, including confiscation of currency, fines, and imprisonment.

What You'll Learn

When to declare currency

If you are entering or exiting the US with currency or monetary instruments (including foreign currency) totalling more than $10,000, you must declare this amount to a Customs and Border Protection (CBP) officer. This can be done online by filling out the Currency Reporting Form (FinCen 105) or by filling out and printing the form and presenting it to a CBP officer. Alternatively, you can ask a CBP officer for a paper copy of the form and fill it out at customs. If you are an international traveller entering the US, you must also declare your currency on CBP Form 6059B.

It is important to note that there is no limit to the amount of money you can travel with when entering or exiting the US. However, failing to declare currency or monetary instruments totalling more than $10,000 can result in serious penalties, including confiscation of all currency or monetary instruments, a fine of up to $500,000, and up to 10 years of imprisonment.

In addition to the federal currency reporting requirements in the US, it is important to check the regulations of the specific country you are travelling to or from, as they may have different rules and restrictions regarding the declaration of currency.

Starbucks Availability at Akron-Canton Airport: A Quick Guide

You may want to see also

How much currency can you bring in/out of a country

When travelling, there are no limits on the amount of cash you can bring into or out of a country. However, if you are entering or exiting the United States with over $10,000, you must declare this to a Customs and Border Protection (CBP) officer. This can be done by filling out the Currency Reporting Form (FinCen 105) online, filling out and presenting a printed Form FinCen 105 to a CBP officer, or asking a CBP officer for a paper copy of the form to fill out at customs. If you are entering the US, you must also declare the amount on your Customs Declaration Form (CBP Form 6059B).

Failure to declare currency valued at over $10,000 when travelling in or out of the US can result in serious penalties, including confiscation of all currency or monetary instruments, a fine of up to $500,000, and up to 10 years of imprisonment.

It is important to note that each country has its own policy regarding travelling with cash, so it is essential to check and comply with the regulations of the specific country you are travelling to or from.

Additionally, when travelling with cash, it is recommended to keep the amount as small as possible and avoid carrying large sums of cash, especially in small denominations such as $20 bills, which are commonly used in drug deals. Instead, consider using alternative payment methods, such as travel credit cards, which offer rewards and protection for your purchases.

Denver Airport: A Morgue Mystery Unveiled

You may want to see also

Fines for not declaring currency

Failing to declare currency can result in serious consequences, including fines, confiscation of funds, and even imprisonment. Here are the potential fines for not declaring currency when travelling:

In the United States, travellers are required to declare any amount exceeding $10,000 to a Customs and Border Protection (CBP) officer when entering or exiting the country. This declaration can be done by filling out the Currency Reporting Form (FinCen 105) online, printing and presenting the form to a CBP officer, or filling out a paper copy at customs. International travellers entering the US must also declare their currency on CBP Form 6059B.

Failing to declare the correct amount of currency can result in a fine of up to $500,000. This fine is in addition to other potential penalties, such as the confiscation of all currency or monetary instruments and imprisonment of up to 10 years. These penalties are enforced by the CBP, who have the authority to seize currency or monetary instruments at the time of the violation.

It is important to note that these rules apply to both entering and exiting the United States, and the reporting requirements must be fulfilled at the time of departure or arrival. Additionally, the rules apply to all travellers, regardless of whether they are aware of the reporting requirements.

Furthermore, the reporting requirements are not limited to cash. They also include other monetary instruments, such as traveller's cheques, money orders, and even gold coins. Therefore, it is essential to be aware of the total value of all monetary items one is carrying when travelling internationally to and from the United States.

In conclusion, failing to declare currency when travelling can result in significant fines and other penalties. To avoid these consequences, it is crucial to comply with the reporting requirements and accurately declare any amounts exceeding the specified limit.

Balloons in Airports: Allowed or Not?

You may want to see also

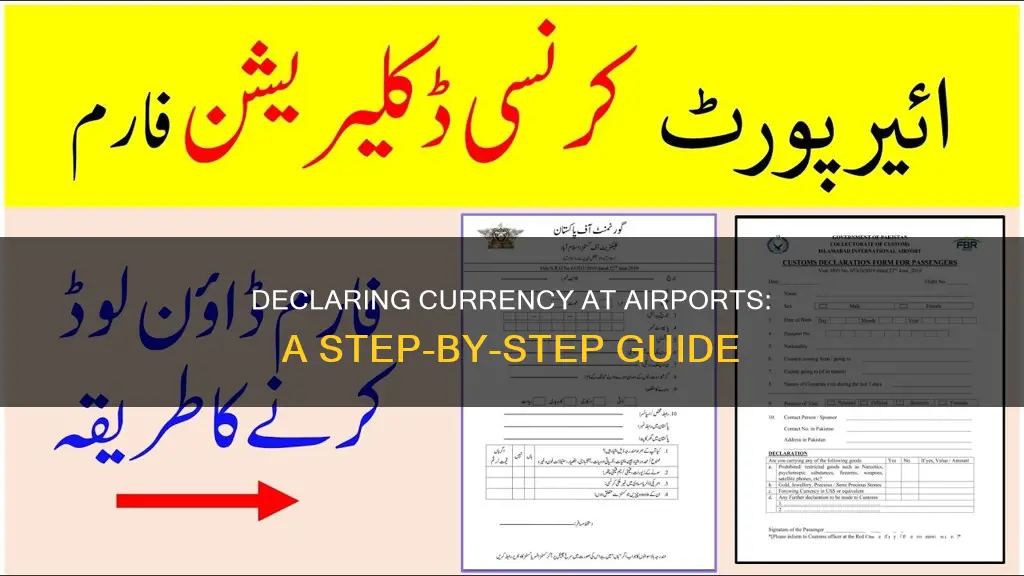

Where to get the required forms

When travelling to or from the US, you must declare the currency you are carrying if it exceeds $10,000. This includes foreign and US paper money and coins. To declare your currency, you will need to fill out a Currency Reporting Form (FinCen 105) and a CBP Form 6059B.

There are a few ways to obtain these forms. One option is to fill out the FinCen 105 form online before your trip and then print it to present to a Customs and Border Protection (CBP) officer upon arrival or departure from the US. Alternatively, you can fill out and print both forms before your trip and present them to the CBP officer when you arrive or before you leave the country. If you are unable to access the forms online or do not have access to a printer, you can ask a CBP officer for a paper copy of the FinCen 105 form at the airport and fill it out by hand.

It is important to note that you must declare any currency or monetary instruments, including foreign and US paper money and coins, that exceed the amount of $10,000. Failure to do so may result in serious penalties, including confiscation of all currency or monetary instruments, a fine of up to $500,000, or even imprisonment for up to 10 years.

Airports and IATA Codes: A Universal Language?

You may want to see also

How to fill out the forms

When filling out the forms, you will need to declare the amount and type of currency you are carrying. This includes both paper money and coins and applies to both US and foreign currency.

You can fill out the Currency Reporting Form (FinCen 105) online before your trip and present a printed copy to a Customs and Border Protection (CBP) officer when you enter or exit the US. Alternatively, you can ask a CBP officer for a paper copy and fill it out at customs. If you are an international traveller entering the US, you must also declare the currency on CBP Form 6059B.

It is important to note that you must report to a CBP officer that you are bringing more than $10,000 into or out of the country. Failure to do so may result in penalties, including confiscation of currency, fines, or even imprisonment.

Sacramento Airport: Masks Still Required?

You may want to see also

Frequently asked questions

The threshold amount is $10,000. If you are traveling with an excess of $10,000, you must report it to a Customs and Border Protection (CBP) officer when entering or exiting the U.S.

To declare currency, you can fill out the Currency Reporting Form (FinCen 105) online, or fill out and print Form FinCen 105 before traveling and present it to a CBP officer. Alternatively, you can ask a CBP officer for a paper copy and fill it out at customs.

Failing to declare currency over the $10,000 threshold can result in serious penalties, including confiscation of all currency or monetary instruments, a fine of up to $500,000, and up to 10 years of imprisonment.