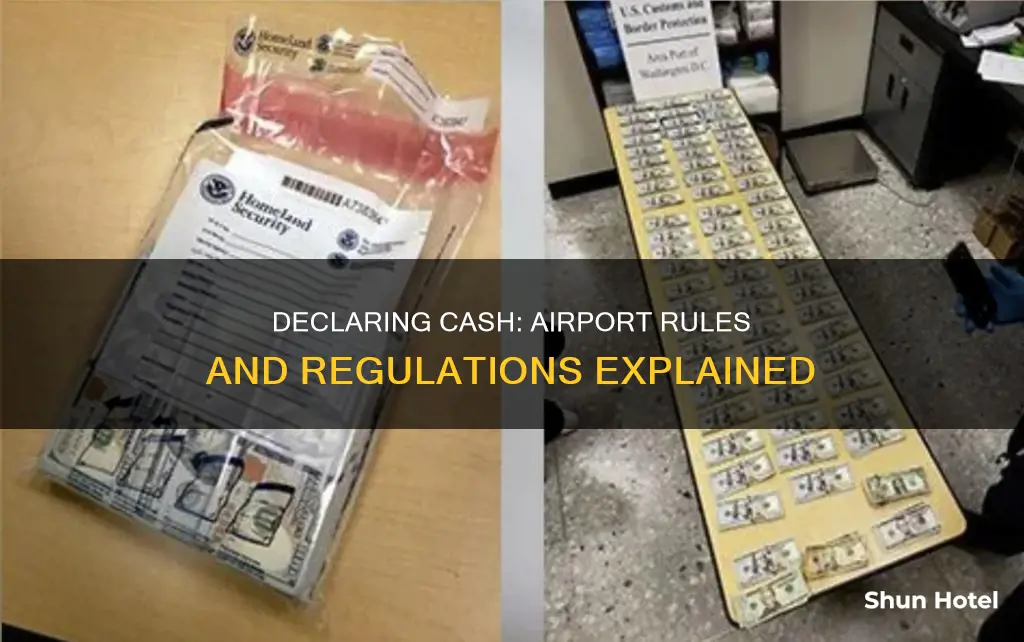

When travelling with large amounts of cash, it is important to be aware of the rules and regulations that govern the declaration of money at airports. While there may be no limit to the amount of money you can carry, failing to declare sums above a certain threshold can result in severe penalties. The specific requirements vary depending on the country and the amount of cash being transported. For example, in the United States, travellers must report amounts exceeding $10,000 to a Customs and Border Protection (CBP) officer and complete specific forms, such as the Currency Reporting Form (FinCen 105) and CBP Form 6059B. Similarly, in New Zealand, a Border Cash Report is mandatory for those carrying NZ$10,000 or more. Non-compliance with these regulations can lead to fines, confiscation of funds, or even imprisonment. It is crucial for travellers to be well-informed about the relevant rules and procedures to ensure a smooth journey and avoid legal consequences.

| Characteristics | Values |

|---|---|

| Amount of money that needs to be declared | More than $10,000 USD or NZ$10,000 |

| Forms to be filled | CBP Form 6059B, FinCEN 105, NZCS 337 Border Cash Report |

| Mode of filling the forms | Online, at the customs, or on paper |

| Items that count towards the limit | Paper money, coins, travellers' checks, money orders, negotiable instruments, investment securities |

| Penalties for non-compliance | Heavy fines, confiscation of funds, confiscation of all currency or monetary instruments, imprisonment |

What You'll Learn

Filling out the Currency Reporting Form (FinCen 105) online

- Access the Form: Visit the official website of the Financial Crimes Enforcement Network (FinCEN), which is a part of the U.S. Department of the Treasury. The website address is https://www.fincen.gov/. From the homepage, look for the "Forms" section and select "FinCEN Form 105 – Currency and Other Monetary Instruments Report."

- Understand the Requirements: Before filling out the form, it's important to understand what information you will need to provide. The form requires personal details about the individual transporting the currency or monetary instruments, including their full name, address, and contact information. Additionally, you will need to provide details about the currency itself, such as the type of currency (e.g., U.S. dollars, foreign currency, or a combination), the amount in each currency, and the total value.

- Provide Travel Information: The form will also ask for information related to your travel. This includes the date of your travel, your mode of transportation (e.g., commercial aircraft, private aircraft, ship, etc.), and the specific port or location where you will be entering or exiting the country.

- Disclose the Purpose: You will need to explain the reason for transporting the currency or monetary instruments. This could include purchasing or selling goods, investing in a business, or simply transporting the funds for personal use. Be as detailed as possible in your explanation.

- Sign and Submit: Once you have completed all the required fields, carefully review your form for accuracy. Then, sign and date the form. If you are filling out the form online, you may need to create an electronic signature or use a digital signature tool. Finally, submit the form by following the instructions provided on the FinCEN website.

- Retain a Copy: It is always a good idea to keep a copy of the completed form for your records. This can be useful for reference or in case you need to provide additional information to customs officials during your travel.

Remember, the requirement to fill out the Currency Reporting Form (FinCen 105) applies when you are transporting more than $10,000 in currency or monetary instruments into or out of the United States. Failing to declare or under-declaring the amount can result in severe penalties, including confiscation of the currency, fines, and even imprisonment.

Amarillo's Airport: Major Hub or Minor Stopover?

You may want to see also

Filling out and printing Form FinCen 105 before travel

If you are entering or exiting the US and are carrying more than $10,000 in currency or monetary instruments, you must declare this to a Customs and Border Protection (CBP) officer. Monetary instruments include paper money, coins, travellers' cheques, money orders, negotiable instruments, and investment securities in bearer form. To do this, you can fill out and print Form FinCen 105 before you travel and present it to the CBP officer.

Form FinCen 105, or the Currency Reporting Form, can be filled out online. Alternatively, you can ask a CBP officer for a paper copy to fill out at customs. If you are an international traveller entering the US, you must also declare your currency on CBP Form 6059B, in addition to Form FinCen 105.

When filling out Form FinCen 105, you will need to provide details about the monetary instruments you are carrying, including the amount and type of currency. You will also need to provide your personal information, such as your name, address, and contact information. It is important to ensure that all information provided is accurate and up-to-date. Once you have completed the form, carefully review your responses before printing and signing the form. Make sure to keep a copy of the completed form for your records.

By filling out and printing Form FinCen 105 before your travel, you can save time at the airport and facilitate a smoother declaration process. It is important to comply with the reporting requirements to avoid any penalties, which may include confiscation of monetary instruments, fines, or even imprisonment.

Please note that there is no limit to the amount of money you can travel with when entering or exiting the US. However, ensuring proper declaration for amounts exceeding $10,000 is crucial.

Airport X-Rays: Can They See Private Parts?

You may want to see also

Asking a Customs and Border Protection (CBP) officer for a paper copy

If you are travelling with more than $10,000 in cash, you must declare this to a Customs and Border Protection (CBP) officer when entering or exiting the US. This is done by filling out the Currency Reporting Form (FinCen 105).

There are a few ways to obtain this form. One option is to ask a CBP officer for a paper copy and fill it out at customs. This is a straightforward process and ensures you are complying with the law. Here is a step-by-step guide to requesting and completing a paper copy of the Currency Reporting Form:

Firstly, locate a CBP officer at the airport. They are usually positioned at customs and can be identified by their uniform and official badges. Approach the officer and explain that you need to declare cash and require a paper copy of the Currency Reporting Form (FinCen 105). The officer should be able to provide you with the form and any necessary instructions.

Once you have obtained the form, find a convenient place to fill it out. Ensure you have all the necessary information at hand, including the amount of cash you are carrying and the type of currency. The form will also require your personal details, such as name, address, and contact information. It is essential to fill out the form accurately and honestly. Provide all the requested information clearly and legibly.

After completing the form, return it to the CBP officer. They may ask you additional questions or request further documentation. Make sure to cooperate and provide any required information. By following these steps, you can confidently declare your cash and continue with your travel plans, knowing that you are complying with the legal requirements.

Remember, it is mandatory to declare amounts exceeding $10,000 to avoid penalties, which can include confiscation of currency, fines, or even imprisonment.

Charlotte Airport's Best Restaurants: A Comprehensive Guide

You may want to see also

Declaring currency or monetary instruments on CBP Form 6059B

When entering the US, currency and monetary instruments, including foreign and US paper money and coins, traveller's cheques, money orders, and negotiable instruments or investment securities in bearer form, must be declared if they exceed $10,000 in total. This applies to all travellers, regardless of citizenship or nationality.

To declare currency, travellers must complete a FinCEN Form 105, Report of International Transportation of Currency or Monetary Instruments, which is available from any US Customs and Border Protection (CBP) officer. This must be done in addition to declaring currency on CBP Form 6059B.

When completing the FinCEN Form 105, travellers must provide the following information:

- Name and address

- Date of arrival in the US

- Value of currency or other monetary instruments being brought into the US

- Country from which the currency or other monetary instruments are being brought

Families residing in one household and submitting a joint declaration must declare the aggregate value of their currency or monetary instruments on their Customs Declaration Form (CBP Form 6059B) when the total amount meets or exceeds the $10,000 limit. Additionally, if any one member of the family is bringing in more than $10,000, they must also file a separate FinCEN Form 105.

Airports and Warrants: What's the Deal?

You may want to see also

Penalties for not declaring cash over $10,000

Failing to declare cash over $10,000 at the airport can result in severe penalties. These penalties can include the confiscation of all currency or monetary instruments, a fine of up to $500,000, and up to 10 years of imprisonment.

If you are travelling with more than $10,000, you must report it to a Customs and Border Protection (CBP) officer when entering or exiting a country. This can be done by filling out the Currency Reporting Form (FinCen 105) online, filling out and presenting a printed Form FinCen 105 to a CBP officer, or asking a CBP officer for a paper copy to fill out at customs. If you are an international traveller, you must also declare the amount of currency on CBP Form 6059B.

It is important to note that there is no limit to the amount of money you can travel with. However, failure to declare cash over $10,000 can lead to serious legal consequences, as mentioned above.

If your money is seized at the airport, you should consult an experienced civil asset forfeiture attorney who can help you fight to get it back. You may also need to file a claim for court action to contest the legality of the seizure. It is important to act quickly, as there are strict and unforgiving deadlines in these cases.

London Airport Shopping: Best Buys Before Takeoff

You may want to see also

Frequently asked questions

There is no limit to the amount of money you can travel with to and from the US. However, if you are entering or exiting the country with more than $10,000, you must report it to a Customs and Border Protection (CBP) officer.

To declare money, you can either fill out the Currency Reporting Form (FinCen 105) online, fill out and print Form FinCen 105 before your travel and present it to a CBP officer, or ask a CBP officer for a paper copy and fill it out at customs. Additionally, if you are an international traveller entering the US, you must declare the amount of currency or monetary instruments you have on CBP Form 6059B.

Failing to report that you are carrying more than $10,000 through customs can result in severe penalties, including confiscation of all currency or monetary instruments, a fine of up to $500,000, and up to 10 years of imprisonment.